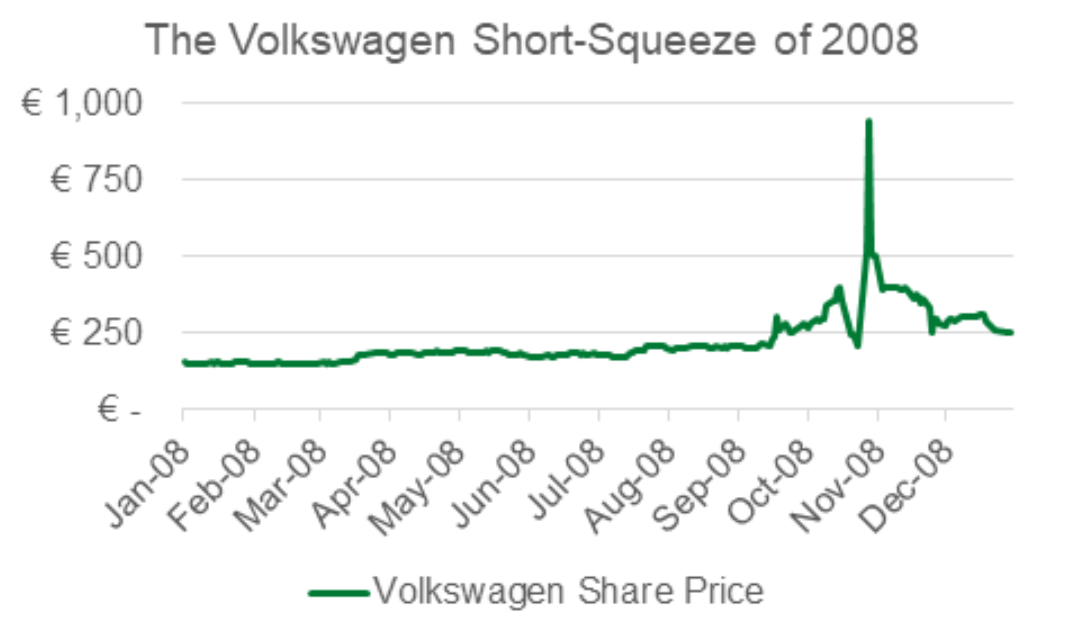

Many funds, derided as asset-stripping locusts in Germany, are facing ruin. Some fund managers were reportedly in tears as they realised the scale of their losses - estimated to be as high as €30bn, and bringing out a large dose of schadenfreude among market watchers. They dumped stocks in Germany's top companies to pay for scarce VW stock. Porsche's announcement forced them to close their positions by chasing the few shares on offer and paying ever-higher prices for them. In market parlance, they "shorted" VW shares by "borrowing" and then selling them in the hope they could buy them back at a much reduced price. With global car companies in freefall as the recession bites into sales and profits, the funds bet hugely on VW's stock falling dramatically. With the federal state of Lower Saxony holding a further 20.2% in VW, that left just 5.7% of the firm's shares traded freely. The panic-buying, which began on Monday, came after hedge funds were caught short by Sunday's announcement from the luxury car-maker Porsche that it had seized 74.1% of VW. The German financial daily Handelsblatt reported that London-based Marshall Wace lost more than €5bn, and two New York funds, Perry Capital and Greenlight Capital, lost billions each.Īmid pandemonium on Frankfurt's stock exchange, VW shares experienced a rollercoaster ride before ending 82% higher on the day at €945, valuing the group at €280bn. VW was worth more than US grocer Wal-Mart, the world's biggest group by sales in this year's Fortune 500 list, Microsoft and General Electric - and substantially more than all of America's and Europe's car-makers combined.īut its gain was the hedge funds' loss. Amid the buying frenzy, the shares touched €1,005 each, five times the level at which they were changing hands on Friday.

Panic-buying by hedge funds drove the company's share price into the stratosphere, allowing VW at one point to leapfrog oil giant ExxonMobil to become the biggest company by stockmarket value at just short of a staggering €300bn (£240bn).

Other manufacturers including Ford and Honda are cutting production.īut Volkswagen, the business that gave the world the Beetle and the camper van, found itself the most valuable company in the developed world yesterday, the result of another bout of financial speculation that went spectacularly wrong. General Motors is burning through $1bn a month and is worth a fraction of what it was.

0 kommentar(er)

0 kommentar(er)